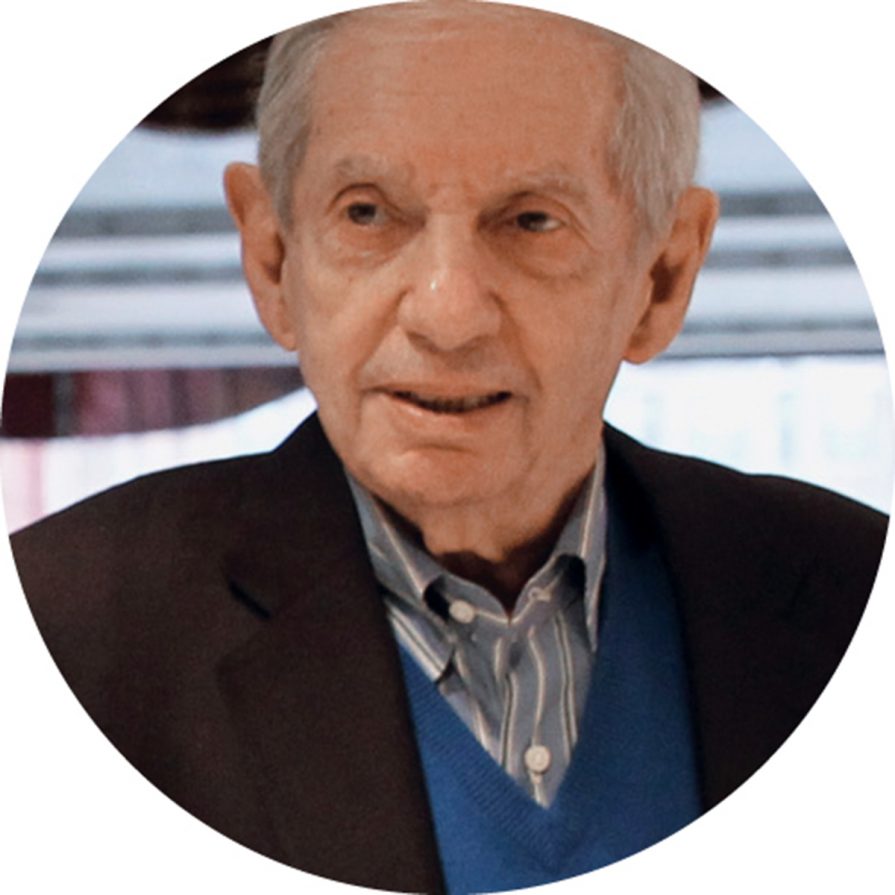

Steven Samuels Is Fenway’s Man with the Golden Charm

How developer Steven Samuels transformed the Fenway from a dump into a destination.

But by the early 1990s, the Fenway was over. Sears had closed up shop in 1988, leaving an empty, mammoth shell. Four years later, longtime Sox owner Jean Yawkey died, leaving the team to John Harrington—who inherited not only a losing team, but also MLB’s smallest, oldest, and most decrepit ballpark. Boylston Street had become Boston’s armpit—where you got your gas, your greasy fries, and your oil changed. “At one time the best thing you could hope to get on Lansdowne Street was a good beating,” Patrick Lyons, who owned the biggest clubs on Lansdowne, told the Herald in 2009.

In 2000, the Sox went up for sale for the first time in more than 60 years, and to jack up their value, Harrington successfully lobbied Boston—terrified of losing the team to another city—to use its powers of eminent domain to help him buy up 15.5 acres south and west of the existing ballpark, at an estimated price of $65 million, so that he or the new owners could rebuild the park at twice the size. Soon after, the city’s chief planner, Kairos Shen, and the Boston Redevelopment Authority swooped in to massage a master plan with the community and various stakeholders, a process that would take years. If all went as planned, the Sox would be in firm command of the Fenway.

The Fenway’s neighborhood organizers needed no introduction to the BRA. They lived in the quiet, tree-lined, five-story-brick-housing pocket along Peterborough and Queensberry streets, and were known as some of Boston’s most active community members—folks like the Fenway Civic Association’s Bill Richardson, Freddie Veikley, and Ed Burke, many of them long-term renters. They’d landed in the Fenway in the ’70s and ’80s, at a time when slumlords sometimes torched their own properties to collect insurance money. They’d seen the neighborhood shift from secretaries and nurses to artists, musicians, and students. They’d witnessed the AIDS epidemic of the ’80s up close. They stuck around because they knew that the Fenway was a rarity in Boston: an affordable residential oasis, a walkable neighborhood, boasting the highest percentage of rentals in the city. So they tolerated Boylston Street’s drunken Sox fans, gas stations, fast-food joints, and band-rehearsal spaces, where—Veikley says—the heavy metal bands practicing at top volume kept the rats away.

But they relentlessly defended their turf. They’d fought for affordable housing and parks and against the incursion of medical-related buildings in their neighborhood. “ Every time they want to do something, they talk to me,” says Burke, who used to work for the city. “Because they know we can screw them. If we can’t cost them money, we can cost them time…. You can mess them around a lot of ways.” They were, one might say, a very engaged and very well-informed group. Exactly the kind of people who could crush a developer’s dreams.

Community buy-in was also crucial for another reason: If Mayor Tom Menino was passionate about anything, it was listening to his neighborhoods. Taking a lesson from the destruction of Boston’s old West End, Menino wrote in his autobiography, “I’d tell developers: Want to build in the neighborhoods? Talk to the neighbors. Convince them that change won’t harm their quality of life.” And everyone knew that the mayor’s support was crucial to getting projects—especially big projects—approved by the BRA.

1960

Then: A vintage postcard of the Fenway Motor Court (noticeably absent: Fenway Park).

illustration courtesy of samuels & associates

2013

Now: A rendering of Samuels’s Verb Hotel, with his 1947 bus parked outside.

illustration courtesy of samuels & associates

The people in the Fenway had demonstrated time and again that they were a force to be reckoned with; in part, that’s what kept developers away. Stephen Karp, owner of a national retail empire and half of Nantucket, told me he saw a “tremendous opportunity” in the Fenway, but claims it wasn’t his kind of business. (Perhaps. Although—as I reminded him—he’d done CambridgeSide Galleria, an enormous urban project if there ever was one.) Golden boy Anthony Pangaro, of Millennium Partners, knew his place, over in Downtown Crossing. Favored son Joe Fallon, backed by MassMutual, stayed in his designated territory, the South Boston waterfront. Second-generation developer John Rosenthal tried to get approval for his air-rights project over the Pike nearby, but the best he could eke out of the Fenway was a new commuter-rail station—built for the MBTA as part of a state-funded infrastructure package. Mega-mogul Norman Levenson owned plenty of residential buildings in the Fenway, but he didn’t go after family-run gas stations or get too involved with master planning.

As the neighborhood people began hammering out the plan with the BRA, two outsiders started showing up to meetings: Steve Samuels, or, in his stead, his executive vice president of development, Peter Sougarides. Samuels had been negotiating for a sizable piece of property between Boylston and Brookline on both sides of Kilmarnock. He thought he’d build an office building or a hotel, and a supermarket, opposite an existing Shaw’s. Perhaps the plan wasn’t sexy, perhaps it was even redundant, but it did play to Samuels’s strengths as a shopping-center guy.

Samuels and Sougarides were quiet, didn’t say much; they’d sit in the back, and when asked, respectfully offered the developer’s perspective on all kinds of things the community was thinking about. In fact, Samuels brought in a heavy dose of reality. Richardson says, “It didn’t take much for Steve to look at [our plans] realistically and say, ‘Here’s your choice: nothing or 250 feet. Because, look, it’s $250 per square foot to build in Boston—union, steel—you are not going to get someone who’s gonna build that low. Either gas stations or 15 floors of development. What do you want?’ Most were willing to take more height in an effort to make things happen out there, to get away from this barren strip of land that ran through the heart of Boston.”

And Samuels didn’t just listen to the neighborhood; when his time came, he delivered. In the four years it took him to acquire the land to build Trilogy—between 1999 and 2003—he shifted his plans from a hotel and supermarket to apartments, largely as a result of the neighborhood meetings. And—at huge added expense—he buried the development’s parking lot. But it was worth it: He’d gained the neighborhood’s trust while encouraging them to dream bigger and better.

Though Samuels had been an unknown among the Fenway folks, he was very well known by Menino. In 1993, the same year Menino took office, Samuels opened the $65 million South Bay Center—“the first supermarket-anchored shopping center in a big Northeast city in a generation,” the Globe declared in 2005. The new mayor quickly warmed up to the young midwestern interloper who was willing to gamble on Dorchester.

At the mayor’s bidding, Samuels then oversaw—pro bono, no less—the development of the $13.5 million Mecca at Grove Hall, a smaller retail center in Roxbury, a place where no other developer dared to tread without imposing hefty fees. In his memoir, Mayor for a New America, Menino didn’t mention Samuels by name. But he made it clear that bringing new development to an underdeveloped part of the city was personal: The construction of Grove Hall mall, he says, fulfilled his “promise to Roxbury.”

It wasn’t the last time Samuels would end up on Menino’s good side. In 2006, Samuels bailed out Nuestra Culinary Ventures—an ailing nonprofit kitchen incubator in Jamaica Plain that Menino strongly endorsed—with a $25,000 gift. And after completing Trilogy, for his second massive Fenway project Samuels leveraged the friendship of another powerful City Hall ally: Harry Collings, Menino’s close friend and former long-serving executive director of the BRA. Collings was the hidden hand who got big real estate deals done. He heard about Samuels through the BRA project managers who’d shepherded the master planning of the Fenway. And Collings had a specific problem that Samuels could solve: As a member of the board and head of the capital campaign for what was then Fenway Community Health (FCH), Collings wanted Samuels to help the organization find a new space.

Eventually, FCH became a major tenant in Samuels’s 1330 Boylston project. Stephen Boswell, president and CEO of Fenway Health, says he understands why Samuels got the gig: “The general sense I got of conversations with the mayor, with Harry, with other people at the BRA, was that Steve was definitely someone who would come into a neighborhood and not offend virtually half of the people in the neighborhood and blow something up.”

Samuels and his employees also gave generously to Menino’s campaigns—$7,000 in 2009—and threw swanky fundraisers for the mayor. Meanwhile, other developers’ checks were being returned, among them Rosenthal’s. By way of explanation, the Globe announced that Rosenthal’s support for Menino’s campaign “may violate the mayor’s longstanding policy of not accepting donations from people with business before a city agency.” His air-rights proposal, which had cost him a decade and millions of dollars, went nowhere for years (he may get it done yet). Mentioning his name to other developers tends to provoke a slow shaking of heads.

One rainy day in October, I went to Fenway Park to meet with Red Sox president and CEO Larry Lucchino to talk about the organization’s take on the development of the neighborhood in general, and Samuels in particular. Samuels had warned me that Lucchino would probably call him “an asshole.” But Lucchino didn’t. Instead, he walked us past the Sox’s main conference room, with a glorious view of the ball field, and pointed to the inscription on the wall, by Globe sportswriter Marty Nolan. “The ballpark is the star,” it read. Lucchino would’ve written it right into my notebook if he’d had the chance: The ballpark is the star.

In a smaller conference room a few feet away, Lucchino had assembled some of the Red Sox’s top brass: senior vice president/Fenway affairs Larry Cancro, vice chairman David Ginsberg, and senior vice president/special counsel David Friedman. The ballpark, Lucchino emphasized, was the center of every decision the ownership group had made since buying the team—and the Red Sox were not now, nor had ever wanted to be, real estate developers. But that didn’t mean that the Sox hadn’t taken an active—often defensive—role in Fenway development. As we sat tightly packed around a large wooden table a few stories above Yawkey Way, Lucchino explained how harmful too-close development could be to the “jewel of Fenway.” Imagine this cell phone is Fenway Park, he said, positioning an iPhone in the middle of the table. Then he reached across the table for an Evian. This—the water bottle, he said—is a potential development. He smashed it up against the phone. And this—he commandeered someone’s can of soda and crowded it in—is development. Someone offered another water bottle and before we knew it, the lowly phone had disappeared behind, well, a towering wall of trash. Lucchino refers to it as “Manhattanization”—a term he attributes to Menino. No, we don’t want this happening to Fenway Park, Lucchino said, as we all nodded gravely.

Of course, back in the late 1990s and early 2000s—when the Sox’s previous ownership was battling Samuels and the neighborhood for the fate of the Fenway—it wasn’t clear what role the team would ultimately play. As time went on, the Harrington-owned Sox began to realize that buying up the 15.5 acres to build a huge new ballpark would cost them a crap-ton of money. When the team came sniffing around for the then-dilapidated hotel—which had been converted to a Howard Johnson— Sage claimed that he was just about to build something really big on that site, which would significantly crank up the cost of a buyout. Sage’s new “plans” for a larger hotel instantly hit all the papers, making his deal appear as if it were just a handshake away.

The estimated price of buying up the 15.5 acres for a new ballpark shot up to at least $180 million. Harrington gave up, and sold the Sox to billionaire John Henry’s group in 2002. Two years later, the BRA finally unveiled its new Fenway zoning, based on the master plan they’d developed with the neighborhood. In a radical departure, it allowed incredible density and height—up to 29 stories at the corner where Brookline and Boylston intersect.

Other developers drooled over Fenway’s possibilities, but hung back, waiting for the Sox to make the first move. The team’s maddening indecision dragged on for years.

Instead, following their preserve-and- protect credo, the Sox lobbied the BRA in 2008 for an actual city-sanctioned Fenway protection district—which would’ve limited the kinds of developments that could, say, block the outfield view of the Citgo sign. Lucchino says, and the BRA’s Kairos Shen confirms, that they never came up with language that satisfied all parties. Instead, the Sox tried to buy their way into safety by making overtures to nearly every property owner around them.

It was this defensive strategy that brought the Sox head to head in a bidding war with Samuels over an ExxonMobil gas station that sat on a corner diagonal from Fenway. Today, both parties take pains to emphasize they’re on good terms. Still, Lucchino recalled, under his breath, that he thought the team had a deal to buy the place first—until he found out Samuels had somehow bested his offer. Cancro, his Fenway affairs guru, chimed in to say that there may have been a misunderstanding and lack of communication over the course of a holiday weekend. But Shen says that there was enough tension over Fenway real estate that at one point, Menino encouraged Samuels and John Henry to talk. Samuels worked his magic, and the two became friends.

Bob Sage eventually sold his crumbling Howard Johnson motel to the developer son of a mega-developer. But it wasn’t Steve Samuels.

One day in 2008, Samuels got a phone call from Adam Weiner informing him that Weiner Ventures now controlled the Sage property. Like Samuels, Weiner has real estate development in his blood. With his father, Steve, he’d built Weiner Ventures into a massive portfolio of shopping centers and investments such as the Mandarin Oriental and the Boston Park Plaza Hotel. Unlike Samuels, Weiner was new to the Fenway. I ask Samuels what went through his head when he found out that the Weiners got the HoJo. “That son of a bitch stole that property right out from under us,” he answers with a wink.

They could’ve become instant rivals— instead, they became partners. Samuels invited Weiner to invest in his Fenway projects and become part of the development team, and shortly thereafter, Weiner entrusted the HoJo property to Samuels, who turned it into the hipster Verb Hotel.

It was a very Samuels way of doing business—a collaborative and creative solution that bolstered both parties. Some have suggested that all along, Weiner’s father, Steve, wanted his son to apprentice with Samuels. Adam had apprenticed with Suffolk Construction’s John Fish. If he was to take over the Weiner fortune, he needed to learn the ropes from a pro, and the senior Weiner apparently had designated Samuels the pro. Not long ago, I met Adam Weiner for drinks and asked him about the Samuels deal. “I just had this gut feeling that this was going to work,” he said. Sipping his Stella at the Bristol Lounge in the Four Seasons, Weiner gushed over Samuels, ever so slightly: “He really is an amazingly honest guy.”

This wasn’t the first time I’d heard someone talk about Samuels this way. Former Boston Phoenix publisher Steve Mindich—who sold his Brookline Avenue buildings to Samuels—is a lifelong hard case, and even he goes soft when he talks about Samuels: “He was just really nice. Quiet. Just the antithesis of everything you seem to think real estate people are—and, in many cases, actually are.” Fenway neighborhood defender Richardson echoes this sentiment: “He did have a vision…a real sense about what the neighborhood could be, and we had that sense, too, and looking for someone to team up. Other people aren’t like that.” Fenway Health’s Boswell agrees: “Steve was very engaged in the charrette, with people, and helping to bring a developer’s perspective, and getting to know people. And no other developer—it always shocks me—interacted with the community the way [Samuels’s team] did.”

Stratton Pagounis, the gas-station negotiator, offers a more colorful take: “You know how people who have money like to stick together, go to the country club or something? Samuels is a regular kind of Joe, that’s my opinion of him. He acts like he’s your brother.” And he shares this one final bit: “When they cut the ribbon for over here [at the 1330 Boylston Street project], my mom’s like, oh my God, she’s never seen Mr. Menino like that—hugging [Samuels] and just in tears. Menino loved him like his own son. I wish Mr. Menino was alive, he’d have told you the same thing.”

This past August, I met Samuels and his company president, Joel Skar, on the 16th floor of Trilogy, in a conference room with a broad view of the city. As we gazed through floor-to-ceiling windows at Van Ness—Samuels’s massive, mixed-use development under construction across the street—I was briefly transfixed by welders’ sparks, cranes, and men at work. Between us stood a coffee-table-size model of Samuels’s plans for the entire Fenway neighborhood. Samuels and Sklar leaned over the model, gesturing at the small cardboard boxes wrapped in paper façades, indicating buildings that were either completed, under construction, or slated for the future.

As we looked back and forth at these two versions of the Fenway—the imagined one, in model form, on the table, and the real one just outside the windows—Samuels and Sklar gave me their rap about filling “the hole in the doughnut” (their metaphor for the Fenway as an empty gap between the hospitals and the Back Bay) and how Van Ness Street could someday be a continuation of Newbury Street. Though they’d no doubt talked about these ideas dozens of times, they spoke to me about their plans as if they’d just come up with them. Look—a private park six stories up. Restaurants! Shopping! Pedestrian walkways! Full-color renderings of a possible future Fenway are propped up at the ready. Look at all the fashionable people who will flock to Boston’s newest urban village, the Fenway!

A few weeks later, when I sat in that same space with their impossibly engaging architect, David Manfredi—who pulled a Dale Carnegie, deftly peppering me with questions about myself —I pointed out that Van Ness, that glorious new Newbury Street to the west, will be about two blocks long, and will be cast in perpetual shade. Yes, he nodded. Not to mention that the anchor retail tenant in Van Ness will be a Target. Not that there’s anything wrong with that. Still, I’m wondering whether maybe the Samuels script, as written, needs a few semantic tweaks. The sheer size of the project—it’s several blocks long and an entire block deep—seems strangely incompatible with a village. A neat toolbox of early-21st-century architectural maneuvers, the building has a daunting curved prow reminiscent of a cruise ship, and three enormous punched windows marking the band of Target that occupies floors two, three, and four. The entire construction isn’t quite sure what it wants to be. It is, however, far better than what came before.

The last time I saw Samuels, he and his team met me at Capital Grille, where I’d pressed him hard on the Sage deal, among other things. I’d asked him if his decision to keep the Verb Hotel low to the ground wasn’t just a savvy move to appease the Sox. He insisted it wasn’t: “It would make sense if we were that Machiavellian,” he said. But clearly, he was bothered by the thought that the person writing about him didn’t yet understand him, so he offered me a ride home.

I braced myself for an earful. But instead, Samuels did what Samuels does: He turned on the charm. It’s in his DNA to turn competitors into partners, skeptics into believers. While his car idled outside my apartment, he talked and he listened. For a couple of hours, we talked and found all sorts of common ground. He didn’t mention the story; he seemed to believe that once we got to know each other, I’d be fair. He’d trust me and we’d have a deal.

When he arrived in the Fenway 20 years ago, Samuels was barely out of his twenties. He was smarter than most, richer than most, and more patient than most. Now, at 55, he sees himself as a game-changer. “Boston’s going to be a little more open-minded,” he’d told me back at the Verb. “There’s a feeling that the city’s going to be different than it’s been for 20 years.” He talks about the evolution of the city, from the days of Ted Kennedy and Whitey Bulger to the Menino years, when “a conservative politician ran the city for years and years and years as a really tightly controlled place.” His candid take on one of his biggest supporters surprises me.

Could the Fenway be a model for development to come? Already, Samuels is laying down track in Allston, and with Weiner, he’s angling to be the first developer to build over the Mass. Pike in more than a generation—over by Boylston and Mass. Ave. “So here’s the thing,” Samuels says, summing up his ambition, “this is about Boston’s future. Whatever Boston culture is going to become is being set now. We can start looking at ourselves more liberally and smile a little bit, and have a little fun.”

This Land Is My Land

The fight over the Fenway wasn’t always pretty, but it came with a great cast of characters.